Reimagine Private Credit Liquidity

Zult platform enables asset managers to acquire new

investors

through new

channels.

Blockchain

Meet AI

Zult combines advanced technologies like blockchain

and AI to create transparency and efficiency.

Focus on Fund

Performance

Let our asset manager solutions help with the rest.

Learn more about Zult Solutions for Asset Managers

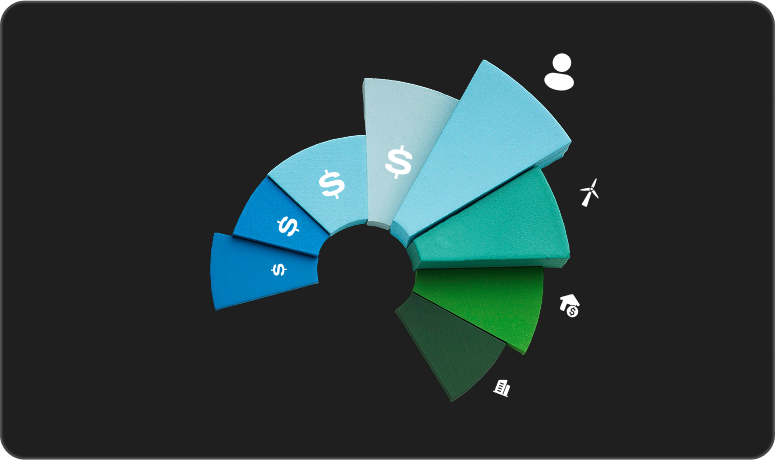

Financial Innovation

for Impact

Zult values private credit investments that create meaningful impact in our communities.

Learn more about Impact Funds